Top Private Market Investment Group EQT Acquires Baring Private Equity Asia for $6.7 Billion, Rename as BPEA EQT & EQT Group with Combined AUM of $95

Baring Private Equity Asia Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Baring Private Equity Asia Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Top Private Market Investment Group EQT Acquires Baring Private Equity Asia for $6.7 Billion, Rename as BPEA EQT & EQT Group with Combined AUM of $95 Billion

Top Private Market Investment Group EQT Acquires Baring Private Equity Asia for $6.7 Billion, Rename as BPEA EQT & EQT Group with Combined AUM of $95 Billion 22nd October 2022 | Hong Kong

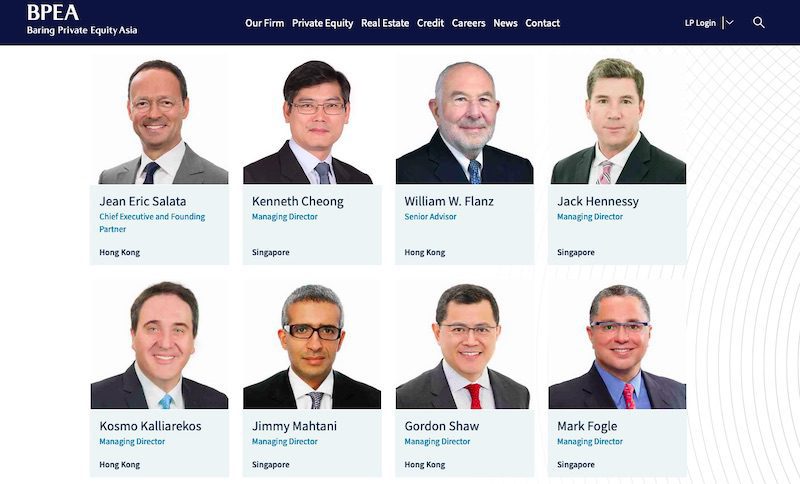

Top private market investment group EQT has completed the acquisition of Baring Private Equity Asia, one of the largest & longest-standing private market investment firms in Asia with $22 billion AUM globally for $6.7 billion. With the acquisition, Baring Private Equity Asia is renamed as BPEA EQT and EQT Group will have a combined AUM of $95 billion (€97 billion, EURUSD 1.01). In 1994, EQT founder & Managing Partner Conni Jonsson received a mandate from the board of Investor AB to establish EQT in 1994 with the backing from Investor AB, AEA Investors & SEB, targeting at industrial companies in Sweden & neighboring countries. The Wallenberg family (Sweden) is one of European most powerful business families. The Wallenberg family through numerous foundations & investment group owns a vast holdings of investments & companies including through Investor AB founded in 1916, with key holdings in leading European & Global companies AstraZeneca, Electrolux, Ericsson, Nasdaq, Saab, SEB Group. In 2019, EQT Group became publicly listed on Nasdaq Stockholm Stock Exchange. With the acquisition, Baring Private Equity Asia (BPEA) Chief Executive & Founding Partner Jean Eric Salata will become Chairman of EQT Asia, Head of BPEA EQT and member of EQT’s Executive Committee.

“ Top Private Market Investment Group EQT Acquires Baring Private Equity Asia for $6.7 Billion, Rename as BPEA EQT & EQT Group with Combined AUM of $95 Billion “

Ads & Announcements

(function(t,e,s,o){var n,c,l;t.SMCX=t.SMCX||[],e.getElementById(o)||(n=e.getElementsByTagName(s),c=n[n.length-1],l=e.createElement(s),l.type="text/javascript",l.async=!0,l.id=o,l.src="https://widget.surveymonkey.com/collect/website/js/tRaiETqnLgj758hTBazgdw_2FrTqLsoWjmVFwM5csk2vL4dBkVAR7ILuYTMMU8NYZ_2F.js",c.parentNode.insertBefore(l,c))})(window,document,"script","smcx-sdk");

(function(t,e,s,o){var n,c,l;t.SMCX=t.SMCX||[],e.getElementById(o)||(n=e.getElementsByTagName(s),c=n[n.length-1],l=e.createElement(s),l.type="text/javascript",l.async=!0,l.id=o,l.src="https://widget.surveymonkey.com/collect/website/js/tRaiETqnLgj758hTBazgdw_2FrTqLsoWjmVFwM5csk2vL4dBkVAR7ILuYTMMU8NYZ_2F.js",c.parentNode.insertBefore(l,c))})(window,document,"script","smcx-sdk"); Earlier in September 2022, Baring Private Equity Asia, had announced the close of its 8th Fund with $11.2 billion (Fund 7 generated 38% IRR), and focused on 7 sectors: Healthcare, Technology, Business Services, Education, Financial Services, Consumer & Advanced Manufacturing. Baring Private Equity Asia 8th fund capital commitment are equally split between local Asian investors, and North America & EMEA. Jean Eric Salata, Chief Executive & Founding Partner of Baring Private Equity Asia (BPEA): “We are grateful to our existing investors who have continued to support us by committing to Fund VIII, and are excited to welcome a large number of new client relationships to the BPEA platform. It is both a privilege and a great responsibility to be a fiduciary for the many institutions, private individuals, and employee retirement funds we are fortunate to count as clients. We operate in one of the most dynamic regions for private market investing, and the scale of BPEA Fund VIII positions our Firm well to capitalize on investment opportunities across the entire Asia Pacific region, future-proofing companies and making a positive impact through our active ownership strategy.”

Conni Jonsson (EQT Founder & Chairperson) founded EQT Partners AB in 1994. He has been Managing Partner since the company’s foundation and as from March 1, 2014, Conni is full time working Chairperson. Prior to founding EQT Partners AB, Conni was employed by the Wallenberg Family Holding Company for seven years as Executive Vice President.

EQT Statement on Baring Private Equity Asia Acquisition

Baring Private Equity Asia

Baring Private Equity Asia

The combination delivers on EQT’s strategic ambition to expand its presence in Asia, a market that is expected to outgrow global private markets3 and EQT believes will be a key contributor to EQT delivering strong long-term returns for its clients. It brings together BPEA’s strong track record and extensive experience of investing across Asia with EQT’s expertise in areas such as sustainability and digitalization. EQT will be “local-with-locals” in countries representing 80 percent of global GDP, enabling it to better leverage insights on a global scale and execute on a broader range of investments, while attracting some of the best talent.

BPEA EQT private capital: an enhanced platform

BPEA EQT combines the private equity teams from BPEA and EQT Asia, with teams based in Beijing, Hong Kong, Mumbai, Seoul, Shanghai, Singapore, Sydney and Tokyo. It builds on 25 years of success in which it has invested in companies such as Hexaware Technologies, Virtusa, and Nord Anglia Education. Prior to completion, BPEA held the final close of the Baring Asia Private Equity Fund VIII at USD 11.2 billion, making it one of the largest private equity funds ever raised in Asia. BPEA’s success is reflected through its 2.4x gross fully and partially realized MOIC since inception.

EQT Exeter doubles down on Asia

EQT’s real estate division, EQT Exeter, is bolstered by the integration of BPEA’s regional Asian real estate business, BPEA Real Estate. The business will continue to operate as one global platform, while benefiting from enhanced talent, skills, knowledge, and capabilities in Asia. It will expand its investments in logistics, office, multi-family, and life sciences, in parallel with EQT Exeter’s global geo-sector specialist strategy.

Christian Sinding, CEO & Managing Partner of EQT:

“Asia is home to more than half of the world’s population and predicted to generate over 40 percent of global GDP within ten years – as a result, it’s expected that the growth of the Asian private market will accelerate at nearly double the pace of global markets through 2025. As a combined firm, we offer local experience and global capabilities – underlined by shared values – that puts EQT in an even stronger position to capture the opportunity through our leading investment strategies across private equity, infrastructure and real estate.”

Jean Eric Salata, Chairman of EQT Asia, Head of BPEA EQT and member of EQT’s Executive Committee: “To succeed in a diverse region like Asia requires strong local relationships as well as global sector and operational capabilities. The combined BPEA EQT platform gives us exactly this, with teams on the ground in eight cities, a thematic investment strategy underpinned by global sector teams, and an active ownership approach driven by deep global networks of industrial advisors and digital capabilities. By joining forces with EQT, we believe we are strengthening our competitive position and ratcheting up our ability to continue delivering strong returns for our clients.”

Ward Fitzgerald, Partner and Head of EQT Exeter:

“This combination is the third leg of global expansion for EQT Exeter. With EQT Exeter’s existing expertise, we are now completing the puzzle to create a major player in sheds, beds and meds. The opportunity in Asia is vast and we look forward to bringing our operating model to the region with the aim to enhance returns for our investors.”

Mark Fogle, Leads EQT Exeter business in Asia: “Ward and team have built an amazing business in North America and Europe, and we are truly excited about the new partnership. The combined platform provides an enhanced ability to be local in all our investment decisions, which has been a core strength of ours and which we believe is critical to succeeding in Asia.”

Key transaction details:

- Following the signing of a definitive agreement to acquire BPEA (the “Transaction”), as announced on 16 March 2022, the Transaction was completed on 18 October 2022

- BPEA and EQT’s Private Equity teams in Asia have combined to form BPEA EQT, and EQT Exeter has integrated BPEA’s Real Estate business. EQT Infrastructure continues to operate globally, while benefiting from BPEA’s pan-regional presence and networks

- EQT acquires 100% of the BPEA management company, the BPEA general partner entities which control selected BPEA funds, and the right to carried interest in selected existing funds (including 25% in BPEA Fund VI and 35% in BPEA Fund VII). EQT will invest in and be entitled to 35% of the carried interest in future BPEA EQT funds, starting with BPEA Fund VIII, in line with existing EQT policies

- The transaction consideration consists of 191.2mn new EQT ordinary shares (corresponding to a dilution of approximately 16%), plus EUR 1.6bn in cash6

- The cash consideration and transaction expenses related to the combination are funded by cash and the net proceeds from a EUR 1.5bn sustainability-linked bond issuance in April 2022

- BPEA has, as of 30 September 2022, EUR 22.1bn in fee-generating assets under management and 225 employees

About EQT

EQT is a purpose-driven global investment organization focused on active ownership strategies. With a Nordic heritage and a global mindset, EQT has a track record of almost three decades of delivering consistent and attractive returns across multiple geographies, sectors and strategies. EQT has investment strategies covering all phases of a business’ development, from start-up to maturity. As of 30 June 2022, EQT had EUR 77 billion in assets under management within two business segments – Private Capital and Real Assets and BPEA had EUR 20 billion in assets under management. With its roots in the Wallenberg family’s entrepreneurial mindset and philosophy of long-term ownership, EQT is guided by a set of strong values and a distinct corporate culture. EQT manages and advises funds and vehicles that invest across the world with the mission to future-proof companies, generate attractive returns and make a positive impact with everything EQT does. The EQT AB Group comprises EQT AB (publ) and its direct and indirect subsidiaries, which include general partners and fund managers of EQT funds as well as entities advising EQT funds. EQT has offices in 23 countries across Europe, Asia-Pacific and the Americas and has close to 1,500 employees. More info: www.eqtgroup.com

About Baring Private Equity Asia

Baring Private Equity Asia (BPEA) is one of Asia’s largest private alternative investment firms, with US$22 billion of FPAUM. BPEA manages a private equity investment program, sponsoring buyouts and providing growth capital to companies for expansion or acquisitions with a particular focus on the Asia Pacific region and dedicated funds focused on private real estate and private credit. The Firm has a 25-year history and over 220 employees across ten offices in Beijing, Delhi, Hong Kong, London, Los Angeles, Mumbai, Singapore, Shanghai, Sydney, and Tokyo. BPEA is a responsible investor that seeks to create value for all stakeholders through a sustainable approach to investing. The Firm is a signatory to the UNPRI (United Nations Principles for Responsible Investment) and is committed to action within its own business and the companies in which it invests to drive sustainability across a range of issues, from climate change to social concerns to effective governance. In March 2022, BPEA reached an agreement to combine with EQT, the purpose-driven global investment organization focused on active ownership strategies. The transaction is expected to close in Q4 2022. For more information, please visit www.bpeasia.com.

2021 Data Release 2020 List of Private Banks in Hong Kong2020 List of Private Banks in Singapore 2020 Top 10 Largest Family Office2020 Top 10 Largest Multi-Family Offices2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM Register Below Latest 2022 data & reports, insights & news Every Saturday & Sunday 2 pm Direct to your inbox Save 2 to 8 hours per week. Organised for success For Investors | Professionals | Executives New to Caproasia? Join 10,000 + Learn More | Sign Up Today Caproasia.com | Caproasia Access 2022 Events | TFC - Find Services Grow Business | Contact Us For CEOs, Heads, Senior Management, Market Heads, Desk Heads, Financial Professionals, Investment Managers, Asset Managers, Fund Managers, Hedge Funds, Boutique Funds, Analysts, Advisors, Wealth Managers, Private Bankers, Family Offices, Investment Bankers, Private Equity, Institutional Investors, Professional Investors Get Ahead in 60 Seconds. Join 10,000 + Save 2 to 8 hours weekly. Organised for Success. Subscribe / Sign Up / Contact Us Sign Up / Subscribe:

Mailing ListFree TrialPromo $20 MonthlyPromo $180 YearlyInvestor $680 YearlyProfessional $680 YearlyExecutive $2,000 Yearly

Interests / Events / Summits / Roundtables / Networking:

Private WealthFamily OfficePrivate BankingWealth ManagementInvestmentsAlternativesPrivate MarketsCapital MarketsESG & SICEO & EntrepreneursTax, Legal & RisksHNW & UHNWs Insights

Your Name*

Company*

Job Title*

Email 1 (Work / Personal)*

Email 2 (Work / Personal)

Contact No.

Country

Your Message (leave blank if none)

Owl Media Group takes pride in providing social-first platforms which equally benefit and facilitate engagement between businesses and consumers and creating much-needed balance to make conducting business, easier, safer, faster and better. The vision behind every platform in the Owl Media suite is to make lives better and foster a healthy environment in which parties can conduct business efficiently. Facilitating free and fair business relationships is crucial for any thriving economy and Owl Media bridges the gap and open doors for transparent and successful transacting. No advertising funds influence the functionality of our media platforms because we value authenticity and never compromise on quality no matter how lucrative the offers from advertisers may seem.