Hong Kong Billionaire Richard Li Insurance Group FWD Considering Direct Stake Sales after IPO Delays, Filed for IPO in United States in 2021 Targeting

FWD Group Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more Caproasia Access | Events | Summits | Register Events | The Financial Centre The 2024 Investment Day | 2024 Family Office Summits | Family Office Circle This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

FWD Group Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more Caproasia Access | Events | Summits | Register Events | The Financial Centre The 2024 Investment Day | 2024 Family Office Summits | Family Office Circle This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Hong Kong Billionaire Richard Li Insurance Group FWD Considering Direct Stake Sales after IPO Delays, Filed for IPO in United States in 2021 Targeting Valuation Around $13 Billion, Filed for Hong Kong IPO in 2023 Targeting Valuation Above $10 Billion

Hong Kong Billionaire Richard Li Insurance Group FWD Considering Direct Stake Sales after IPO Delays, Filed for IPO in United States in 2021 Targeting Valuation Around $13 Billion, Filed for Hong Kong IPO in 2023 Targeting Valuation Above $10 Billion 16th February 2024 | Hong Kong

Hong Kong billionaire Richard Li insurance group FWD is considering direct stake sales after IPO delays. FWD Group had filed for IPO in United States in 2021 targeting valuation around $13 billion, and had filed for Hong Kong IPO in 2023 targeting valuation above $10 billion. In 2013, Richard Li Tzar Kai, who is the son of Hong Kong’s richest man Li Ka-Shing had acquired Dutch financial services group ING’s insurance businesses in Hong Kong, Macau and Thailand for $1.8 billion under Pacific Century Group, and injected the businesses into the created insurance company FWD. FWD shareholders include Pacific Century Group, Swiss Re, GIC Ventures, RRJ Capital and Hopu Investments. Earlier in February 2024, Hong Kong billionaire Richard Li Pacific Century Group (PCG) had been reported to be selling their majority shareholding in $157 billion asset manager PineBridge Investments, having acquired the asset management business from AIG Investments in 2010 & renaming as PineBridge Investments.

“ Hong Kong Billionaire Richard Li Insurance Group FWD Considering Direct Stake Sales after IPO Delays, Filed for IPO in United States in 2021 Targeting Valuation Around $13 Billion, Filed for Hong Kong IPO in 2023 Targeting Valuation Above $10 Billion “

- Article continues below - Quick Links, Ads & Announcements Caproasia Access | Events | Summits | Register Events | The Financial Centre The 2024 Investment Day | 2024 Family Office Summits | Family Office Circle Sign Up Basic Member: $5 Monthly | $60 Yearly Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680) The 2024 Investment Day 6th March Hong Kong | 13th March Singapore Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Taking place on 6th March 2024 in Hong Kong, 13th March 2024 in Singapore. Visit | Register here The 2024 Family Office Summit10th April Hong Kong | 24th April Singapore Join 100+ single family offices & family office professionals in Hong Kong & Singapore Links: 2024 Family Office Summit | Register here

Hong Kong Insurance Group FWD Files for US IPO in United States, Valuation Around $13 Billion

FWD Group

FWD Group 17th June 2021 – Hong Kong insurance group FWD has filed for IPO in the United States under the holding company PCGI Intermediate Holdings, which could value the company at around $13 billion to $15 billion. In 2013, Richard Li Tzar Kai, who is the son of Hong Kong’s richest man Li Ka-Shing had acquired Dutch financial services group ING’s insurance businesses in Hong Kong, Macau and Thailand for $1.8 billion under Pacific Century Group, and injected the businesses into the created insurance company FWD.

FWD IPO, Raising $2 – 3 Billion, Value $13 Billion

The United States IPO filing comes under FWD holding company PCGI Intermediate Holdings. The IPO timeline and terms have not been disclosed or finalised, with market expecting FWD Group to raise between $2 and $3 billion that could value FWD Group at around $13 billion to $15 billion.

FWD Group is in 10 markets in Asia offering life and medical insurance, general insurance, employee benefits, Shariah and family takaful products. FWD Group has more than 9.8 million customers, 6,100 employees, 33,000 ages, $62.6 billion in assets, $5 billion gross premiums in 7 years, 18 bancassurance partners and more than 20 ecosystem partners in Asia.

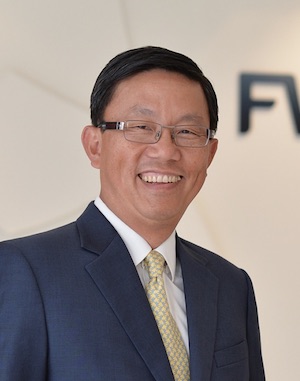

FWD Group CEO, Huynh Thanh Phong, OBE

FWD Group CEO, Huynh Thanh Phong, OBE

FWD Group CEO, Huynh Thanh Phong, OBE FWD Group CEO is Huynh Thanh Phong, OBE, who has over 30 years of industry experience spanning North America, Asia and the Middle East, including several key leadership roles.

Huynh Thanh Phong sits on numerous executive boards including Board Chairman of FWD Life Hong Kong. A Vietnamese-Canadian, Phong is also a qualified actuary, and in the UK has been awarded an OBE by Queen Elizabeth II for his exemplary contribution to financial services in Vietnam.

FWD Shareholders

FWD shareholders include Pacific Century Group, Swiss Re, GIC Ventures, RRJ Capital and Hopu Investments.

Pacific Century Group Chairman Richard Li Tzar Kai

Pacific Century Group Chairman Richard Li Tzar Kai Richard Li Tzar Kai, who is the son of Hong Kong’s richest man Li Ka-Shing, is the Chairman of Pacific Century Group. He founded Pacific Century Group (PCG) in 1993, an Asia-based long-term private investment group with interests across three core business pillars; technology, media & communications (TMT), financial services, and property. Pacific Century Group holdings include fund management firm PineBridge Investments, FWD Group, bolttech, PCCW, HKT and Pacific Century Premium Developments.

Managing $20 million to $3 billion. Investing $3 million to $300 million. For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm. Join Events & Find Services Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services. Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at [email protected] or [email protected] Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Quick Links Caproasia Access | Events | Summits | Register Events | The Financial Centre The 2024 Investment Day | 2024 Family Office Summits | Family Office Circle 2021 Data Release 2020 List of Private Banks in Hong Kong2020 List of Private Banks in Singapore 2020 Top 10 Largest Family Office2020 Top 10 Largest Multi-Family Offices2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM For Investors | Professionals | Executives Latest data, reports, insights, news, events & programs Everyday at 2 pm Direct to your inbox Save 2 to 8 hours per week. Organised for success Register Below For CEOs, Heads, Senior Management, Market Heads, Desk Heads, Financial Professionals, Investment Managers, Asset Managers, Fund Managers, Hedge Funds, Boutique Funds, Analysts, Advisors, Wealth Managers, Private Bankers, Family Offices, Investment Bankers, Private Equity, Institutional Investors, Professional Investors Get Ahead in 60 Seconds. Join 10,000 + Save 2 to 8 hours weekly. Organised for Success. Sign Up / Register You are:

InvestorProfessionalFamily OfficeExecutive

Select:

SubscriptionMembershipEvents

Interests / Events / Summits / Roundtables / Networking:

Professional InvestorPrivate WealthFamily OfficePrivate BankingWealth ManagementInvestmentsAlternativesPrivate MarketsCapital MarketsESG & SICEO & EntrepreneursTax, Legal & RisksHNW & UHNWs Insights

Your Name*

Company*

Job Title*

Email 1 (Work / Personal)*

Email 2 (Work / Personal)

Country

New to Caproasia Learn More | Sign Up | Subscribe | Register Events Caproasia Users

New to Caproasia Learn More | Sign Up | Subscribe | Register Events Caproasia Users - Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

- Professional Investor

- Family Office

- HNW Partnership

- Family Office Circle

- Family Office Networking

- Family Office Roundtable

- The Family Office Summit

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Owl Media Group takes pride in providing social-first platforms which equally benefit and facilitate engagement between businesses and consumers and creating much-needed balance to make conducting business, easier, safer, faster and better. The vision behind every platform in the Owl Media suite is to make lives better and foster a healthy environment in which parties can conduct business efficiently. Facilitating free and fair business relationships is crucial for any thriving economy and Owl Media bridges the gap and open doors for transparent and successful transacting. No advertising funds influence the functionality of our media platforms because we value authenticity and never compromise on quality no matter how lucrative the offers from advertisers may seem.