Credit Suisse Starts Restructuring Plan, Potential Job Cuts of 10% of Workforce Affecting 4,000 to 5,000 Employees

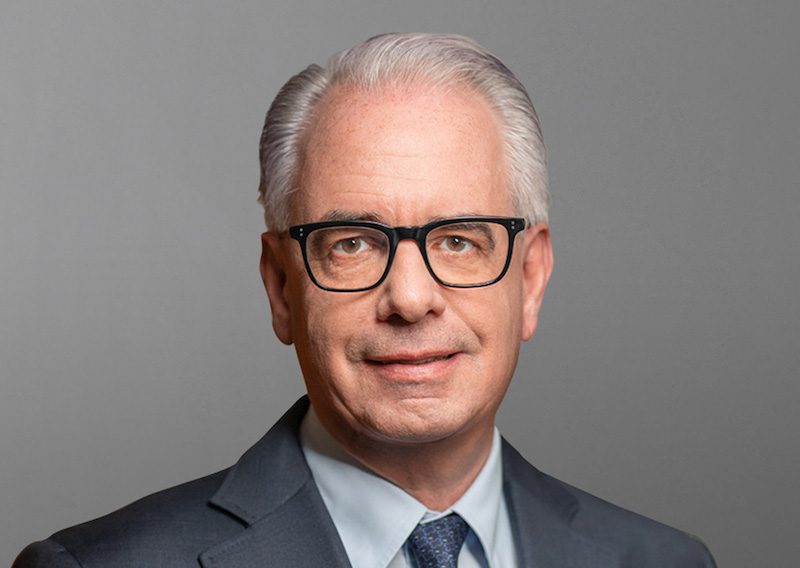

Credit Suisse Group CEO Ulrich Korner Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more Contact Us / Sign Up: Click here Visit: Caproasia.com | Caproasia Access | 2022 Events | TFC - Find Services | Grow Business | Sign Up For Media, Events, Networking, Roundtable, Membership - Contact Us Grow Your Clients, Business & AUM. Start in 24 hours. List Services: HNW | Private Wealth | Family Office | Investment This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Credit Suisse Group CEO Ulrich Korner Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more Contact Us / Sign Up: Click here Visit: Caproasia.com | Caproasia Access | 2022 Events | TFC - Find Services | Grow Business | Sign Up For Media, Events, Networking, Roundtable, Membership - Contact Us Grow Your Clients, Business & AUM. Start in 24 hours. List Services: HNW | Private Wealth | Family Office | Investment This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Credit Suisse Starts Restructuring Plan, Potential Job Cuts of 10% of Workforce Affecting 4,000 to 5,000 Employees

Credit Suisse Starts Restructuring Plan, Potential Job Cuts of 10% of Workforce Affecting 4,000 to 5,000 Employees 2nd September 2022 | Hong Kong

Credit Suisse with new leadership and new senior management team has started restructuring plan, with potential job cuts of 10% of global workforce that may affect 4,000 to 5,000 employees. Earlier in July 2022, Credit Suisse has announced the appointment of UBS CEO of Asset Management Ulrich Korner as the new UBS Group CEO (1/8/22), replacing Thomas Gottstein who is resigning. The announcement was made at the 2022 Q2 earnings release, with Credit Suisse reporting net revenues of CHF 3.6 billion and pre-tax loss of CHF 1.2 billion. Credit Suisse has also announced a strategic review of Credit Suisse 3 key businesses: Wealth Management, Investment Banking and Securitized Products Business. Credit Suisse: “Credit Suisse’s roots lie in its strong global wealth management, universal banking in Switzerland and asset management franchises. The priority of the strategic review will be to enhance these positions, while considering options for fundamentally reshaping the Investment Bank into a highly competitive Banking and more sustainable Markets business that complements Wealth Management and the Swiss Bank. In Wealth Management, Credit Suisse will aim to extend its leadership positions across Switzerland, EMEA, parts of the Americas and APAC leveraging its strengths in the Ultra High Net Worth sector while accelerating Core High Net Worth growth to drive recurring revenues, supported by a unified global platform. The bank’s leadership position in Switzerland will be further enhanced by building on ‘high-touch’ capabilities across wealth management, corporate and institutional clients and accelerating ‘high-tech’ activities through the CSX proposition.”

“ Credit Suisse Starts Restructuring Plan, Potential Job Cuts of 10% of Workforce Affecting 4,000 to 5,000 Employees “

2021 Data Release 2020 List of Private Banks in Hong Kong2020 List of Private Banks in Singapore 2020 Top 10 Largest Family Office2020 Top 10 Largest Multi-Family Offices2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM New to Caproasia? Join 10,000 + Financial Professionals & Professional Investors Learn More | Sign Up Today Caproasia.com | Caproasia Access 2022 Events | TFC - Find Services Grow Business | Contact Us Credit Suisse Appoints Dixit Joshi as CFO, Francesca McDonagh as COO, Michael J. Rongetti as CEO Asset Management, Francesco De Ferrari as CEO EMEA

Credit Suisse Zurich

Credit Suisse Zurich In August, Credit Suisse made numerous senior executive appointments, with Dixit Joshi as Credit Suisse new CFO (1/10/22, Group Treasurer from Deutsche Bank), Francesca McDonagh as the new COO, Michael J. Rongetti as CEO Asset Management, and Francesco De Ferrari as interim CEO of EMEA (Europe, Middle East and Africa) in additional to his role as CEO of Wealth Management. Axel P. Lehmann, Chairman of the Board of Directors: “I am delighted to welcome Dixit, Francesca, Michael and Michael to their new roles. Dixit and Francesca are joining Credit Suisse with impressive track records, adding a wealth of experience at this important juncture. All four are expected to drive our strategic and operational transformation into the future, with the clear objective to position Credit Suisse for a successful future and realize its full potential.” Ulrich Körner, Group CEO: “I would like to welcome Dixit and Francesca to Credit Suisse, while congratulating Michael and Michael on taking their respective new roles. They all join with extensive professional experience and a profound knowledge of the financial services industry, as we accelerate our efforts to make Credit Suisse a stronger, simpler and more efficient Group with more sustainable returns. Dixit has an impressive turnaround track-record, with a broad experience across a range of investment-banking businesses, which will be invaluable on our journey in transforming the Investment Bank into a highly competitive Banking and more sustainable Markets business that complements Wealth Management and the Swiss Bank. I would like to thank Francesco for taking on the role of CEO of the EMEA region on top of his responsibilities as CEO of the Wealth Management division. At the same time, I would like to thank David for his many years of service and his continued commitment to Credit Suisse, helping ensure a smooth transition period.”

Dixit Joshi rejoins Credit Suisse, taking up the role of CFO on October 1, 2022. He will replace David Mathers who decided to step down after more than 11 years in his role as previously communicated. For the past five years, Dixit Joshi served as Group Treasurer at Deutsche Bank, where he played a key part in the bank’s restructuring while overhauling the firm’s balance sheet. During his career spanning three decades, he held various senior investment banking roles across different geographies, helping oversee a series of businesses as well as complex transformation projects. Previously, Dixit Joshi served as Deutsche Bank’s Head of the Fixed-Income Institutional Client Group, Listed Derivatives and Markets Clearing as well as Head of Global Prime Finance and as Head of APAC Equities in Hong Kong. Before joining Deutsche Bank in 2011, Dixit Joshi held senior roles at Barclays Capital. Between 1995 and 2003, he worked for Credit Suisse in New York and London, having started his career in 1992 at Standard Bank of South Africa. Dixit Joshi has a Bachelor of Science degree in Actuarial Science and Statistics from the University of Witwatersrand, South Africa. He will be based in Zurich.

Francesca McDonagh, who was previously announced as CEO of the EMEA region, is appointed Group Chief Operating Officer, starting on September 19, 2022. This new role will support the Group CEO in the steering and strategic development of the Group including operational and cost transformation. She will also lead the enterprise architecture development, including focusing on organizational design and bank-wide efficiencies. Francesca McDonagh most recently served as Group CEO at the Bank of Ireland after holding several senior management roles at HSBC Group. She will be based in Zurich.

Francesco De Ferrari, CEO of the Wealth Management division, who has acted as ad interim CEO of the EMEA region, is appointed to take over the role on a permanent basis with immediate effect.

Michael J. Rongetti will take over as ad interim CEO of the Asset Management division with immediate effect, replacing Ulrich Körner who was appointed Group CEO. In addition, he will continue to serve as Head of Asset Management Americas and Global Head of Investments and Partnerships. Previously, Michael J. Rongetti was CFO of the Asset Management Division (2012 to 2021) as well as CFO for Private Banking Wealth Management Products (2013 to 2015). He joined Credit Suisse in 1998 and will continue to be based in New York.

Michael Bonacker is appointed Group Head of Transformation, leading the operating model and cost transformation work for the Group. He will start his new role on September 1, 2022, reporting to Francesca McDonagh once she joins the company. Michael Bonacker is currently Vice Chairman of Investment Banking & Capital Markets EMEA and a member of the Client Advisory Group. Before joining Credit Suisse in February 2022, Michael Bonacker worked as Global Senior Advisor for Oliver Wyman and also served as Head of Corporate Development at UBS Group. In a career spanning more than 30 years, he also held leadership positions at BHF-Bank, Commerzbank, Lehman Brothers/Nomura, Deutsche Bank and McKinsey. He will be based in Zurich.

Ulrich Korner, UBS Group CEO

Credit Suisse Group CEO Ulrich Korner

Credit Suisse Group CEO Ulrich Korner Ulrich Körner joined Credit Suisse April 1, 2021, as CEO Asset Management. He joined from UBS where he served as member of the group executive board for eleven years, of which six years leading the Asset Management division. Prior to this role he served as Chief Operating Officer. From 2011 he additionally headed the region Europe, Middle East and Africa for UBS. Before joining UBS, he was an executive at Credit Suisse and held various roles, including Chief Financial Officer and Chief Operating Officer of Credit Suisse Financial Services and CEO Switzerland. Ulrich Körner holds a PhD in Business Administration from the University of St. Gallen (HSG).

Axel P. Lehmann, Chairman of Credit Suisse:

Credit Suisse Axel P. Lehmann

Credit Suisse Axel P. Lehmann “I am delighted to welcome Ueli as our new Group CEO, to oversee this comprehensive strategic review at a pivotal moment for Credit Suisse. With his profound industry knowledge and impressive track record, Ueli will drive our strategic and operational transformation, building on existing strengths and accelerating growth in key business areas. Since becoming Chairman and reviewing the bank’s portfolio with our newly refreshed Board of Directors, I have come to appreciate the world-class quality of our businesses. But we need to be more flexible to ensure they have the necessary resources to compete. Our goal must be to become a stronger, simpler and more efficient Group with more sustainable returns. I would like to thank Thomas for his commitment to Credit Suisse over more than two decades and in particular as Group CEO. He has made an enormous contribution to Credit Suisse and always served our clients in Switzerland and beyond with integrity and entrepreneurial spirit. I wish him all the best in his future endeavors.”

Thomas Gottstein, outgoing CEO of Credit Suisse:

Thomas Gottstein Credit Suisse CEO

Thomas Gottstein Credit Suisse CEO “It has been an absolute privilege and honor to serve Credit Suisse over these past 23 years. Credit Suisse has formidable client franchises in all four divisions globally and an immense talent pool across more than 50,000 colleagues worldwide. Despite the challenges of the past two years, I am immensely proud of our achievements since joining the Executive Board seven years ago and more recently in strengthening the bank, recruiting a top-caliber Executive Board, reducing risk and fundamentally improving our risk culture. In recent weeks, for personal and health-related considerations, and after discussions with Axel and my family, I concluded that now would be the right time to step aside and clear the way for new leadership to fully embrace the important initiatives announced this morning, which I wholeheartedly support.”

Ulrich Körner, new CEO of Credit Suisse:

Credit Suisse Group CEO Ulrich Korner

Credit Suisse Group CEO Ulrich Korner “I thank the Board of Directors for the trust they have placed in me as we embark on this fundamental transformation. I am looking forward to working with all colleagues across the bank and the Executive Board and devoting my full energy to execute on our transformation. This is a challenging undertaking but at the same time represents a great opportunity to position the bank for a successful future and realize its full potential. I would also like to thank Thomas wholeheartedly for his support and partnership.”

Credit Suisse Announcement

Credit Suisse Group AG (Credit Suisse) announced the appointment of Ulrich Körner as Group Chief Executive Officer from August 1, 2022, replacing Thomas Gottstein, who is resigning. At the same time, the bank has announced that it is conducting a comprehensive strategic review with the following objectives:

- Consider alternatives that go beyond the conclusions of last year’s strategic review, particularly given the changed economic and market environment. The goal of the appraisal will be to shape a more focused, agile Group with a significantly lower absolute cost base, capable of delivering sustainable returns for all stakeholders and first-class service to clients.

- Strengthen its world-class global wealth management franchise, leading universal bank in Switzerland and multi-specialist asset management business.

- Transform the Investment Bank into a capital-light, advisory-led Banking business and more focused Markets business that complements the growth of the wealth management and Swiss Bank franchises.

- Evaluate strategic options for the Securitized Products business, which may include attracting third-party capital into this market-leading, high-return platform, to capture untapped growth opportunities and free up additional resources for the bank’s growth areas.

- Reduce the Group’s absolute cost base to below CHF 15.5 bn in the medium term, in part through a company-wide digital transformation that prudently ensures durable savings while remaining focused on improving risk management and risk culture.

Credit Suisse will provide further details on the progress of the strategic review, including specific performance goals, with its third-quarter 2022 results.

Credit Suisse

Credit Suisse is one of the world’s leading financial services providers. Our strategy builds on Credit Suisse’s core strengths: its position as a leading wealth manager, its specialist investment banking capabilities and its strong presence in our home market of Switzerland. We seek to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. Credit Suisse employs approximately 51,030 people. The registered shares (CSGN) of Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

For CEOs, Heads, Senior Management, Market Heads, Desk Heads, Financial Professionals, Investment Managers, Asset Managers, Fund Managers, Hedge Funds, Boutique Funds, Analysts, Advisors, Wealth Managers, Private Bankers, Family Offices, Investment Bankers, Private Equity, Institutional Investors, Professional Investors Get Ahead in 60 Seconds. Join 10,000 + Sign Up / Contact Us

For CEOs, Heads, Senior Management, Market Heads, Desk Heads, Financial Professionals, Investment Managers, Asset Managers, Fund Managers, Hedge Funds, Boutique Funds, Analysts, Advisors, Wealth Managers, Private Bankers, Family Offices, Investment Bankers, Private Equity, Institutional Investors, Professional Investors Get Ahead in 60 Seconds. Join 10,000 + Sign Up / Contact Us Sign Up:

Free TrialBasic $120Professional $380Executive $2,000MembershipTeam / Corporate

Interests / Events / Summits / Roundtables / Networking:

Private WealthFamily OfficePrivate BankingWealth ManagementInvestmentsAlternativesPrivate MarketsCapital MarketsESG & SICEO & EntrepreneursTax, Legal & RisksHNW & UHNWs Insights

Your Name*

Company*

Job Title*

Email 1*

Email 2

Country

Your Message (leave blank if none)

Owl Media Group takes pride in providing social-first platforms which equally benefit and facilitate engagement between businesses and consumers and creating much-needed balance to make conducting business, easier, safer, faster and better. The vision behind every platform in the Owl Media suite is to make lives better and foster a healthy environment in which parties can conduct business efficiently. Facilitating free and fair business relationships is crucial for any thriving economy and Owl Media bridges the gap and open doors for transparent and successful transacting. No advertising funds influence the functionality of our media platforms because we value authenticity and never compromise on quality no matter how lucrative the offers from advertisers may seem.