$154 Billion Bridgewater Associates Hedge Fund Manager & Founder Ray Dalio to Give up Control & Voting Rights on 30th September 2022, Founded 47 Years

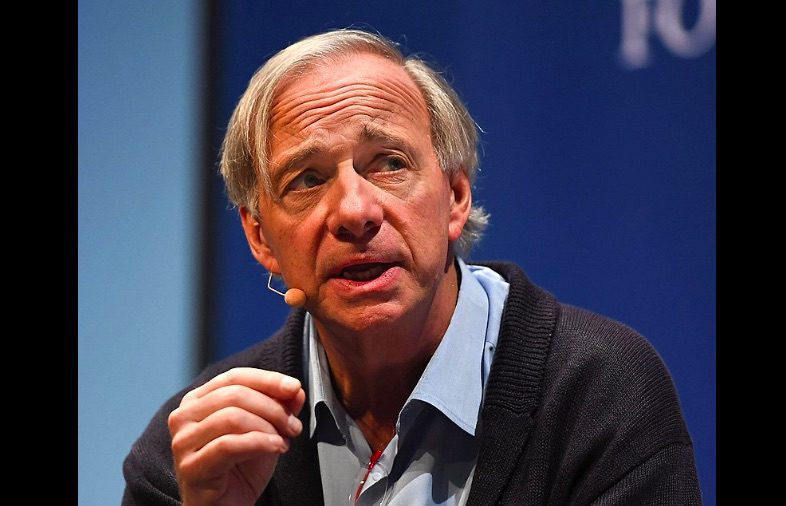

Founder of Bridgewater Associates Ray Dalio Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

Founder of Bridgewater Associates Ray Dalio Caproasia.com | The leading source of data, research, information & resource for investment managers, professional investors, UHNW & HNW investors, and advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets? Caproasia - Learn more This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $3 billion.

$154 Billion Bridgewater Associates Hedge Fund Manager & Founder Ray Dalio to Give up Control & Voting Rights on 30th September 2022, Founded 47 Years Ago in Bedroom

$154 Billion Bridgewater Associates Hedge Fund Manager & Founder Ray Dalio to Give up Control & Voting Rights on 30th September 2022, Founded 47 Years Ago in Bedroom 6th October 2022 | Hong Kong

Top hedge fund manager & founder of $154 billion Bridgewater Associates Ray Dalio has announced to give up control & voting rights of Bridgewater Associates on 30th September 2022, 47 years after starting the hedge fund in 1975 out of a 2-bedroom apartment. Today, Bridgewater Associates is one of the world’s largest hedge fund and in 2022, estimated Assets under Management (AUM) of around $154 billion. The flagship fund of Bridgewater Associates is Pure Alpha. Ray Dalio, a billionaire, is estimated to have a fortune of around $22 billion. Ray Dalio will retain a minority stake & a board seat, and take on the title of founder & mentor. The 2 co-CIOs (Chief Investment Officers) are Bob Prince and Greg Jensen. ay Dalio and his wife Barbara, are active philanthropist and their family office activities includes running Dalio Philanthropies. They are also early signers of the Giving Pledge in 2011, created by Bill and Melinda Gates and Warren Buffett in 2010. The pledge commits signers to give the majority of their wealth to philanthropy or charitable causes, during their lifetimes or in their wills.

” $154 Billion Bridgewater Associates Hedge Fund Manager & Founder Ray Dalio to Give up Control & Voting Rights on 30th September 2022, Founded 47 Years Ago in Bedroom “

Ray Dalio $154 Billion Bridgewater Associates Open Office in Singapore, Setup Family Office in Singapore & Donated $25 Million to WMI in 2020 Founder of Bridgewater Associates Ray Dalio

Founder of Bridgewater Associates Ray Dalio In September 2022,Ray Dalio Bridgewater Associates opened an office in Singapore, 2 years after setting up his family office in Singapore and donating $25 million to Singapore’s Wealth Management Institute (2020). The Singapore office will be led by Chip Packard (Eurasia Head of Client Services) and Margaret Wang (Head of Bridgewater Associates Singapore). Ray Dalio had founded hedge fund Bridgewater Associates in 1975 out of a 2-bedroom apartment. Today, Bridgewater Associates is one of the world’s largest hedge fund and in 2022, with estimated Assets under Management (AUM) of around $154 billion. The flagship fund of Bridgewater Associates is Pure Alpha. Ray Dalio, a billionaire, is estimated to have a fortune of around $22 billion. Ray Dalio joins many American, European & global investment managers and billionaires in setting up investment firms and family offices in leading financial centres in Asia, in Singapore and Hong Kong.

Ads & Announcements

(function(t,e,s,o){var n,c,l;t.SMCX=t.SMCX||[],e.getElementById(o)||(n=e.getElementsByTagName(s),c=n[n.length-1],l=e.createElement(s),l.type="text/javascript",l.async=!0,l.id=o,l.src="https://widget.surveymonkey.com/collect/website/js/tRaiETqnLgj758hTBazgdw_2FrTqLsoWjmVFwM5csk2vL4dBkVAR7ILuYTMMU8NYZ_2F.js",c.parentNode.insertBefore(l,c))})(window,document,"script","smcx-sdk");

(function(t,e,s,o){var n,c,l;t.SMCX=t.SMCX||[],e.getElementById(o)||(n=e.getElementsByTagName(s),c=n[n.length-1],l=e.createElement(s),l.type="text/javascript",l.async=!0,l.id=o,l.src="https://widget.surveymonkey.com/collect/website/js/tRaiETqnLgj758hTBazgdw_2FrTqLsoWjmVFwM5csk2vL4dBkVAR7ILuYTMMU8NYZ_2F.js",c.parentNode.insertBefore(l,c))})(window,document,"script","smcx-sdk"); Ray Dalio, Bridgewater Associates

Dalio Philanthropies

Dalio Philanthropies Ray Dalio, founded hedge fund Bridgewater Associates in 1975 out of a 2-bedroom apartment. Today, Bridgewater Associates is one of the world’s largest hedge fund and in 2022, estimated Assets under Management (AUM) of around $154 billion. The flagship fund of Bridgewater Associates is Pure Alpha. Ray Dalio, a billionaire, is estimated to have a fortune of around $22 billion.

Ray Dalio Philanthropic Activities

Ray Dalio and his wife Barbara, are active philanthropist and their family office activities includes running Dalio Philanthropies. They are also early signers of the Giving Pledge in 2011, created by Bill and Melinda Gates and Warren Buffett in 2010. The pledge commits signers to give the majority of their wealth to philanthropy or charitable causes, during their lifetimes or in their wills.

$25 Million to Singapore Wealth Management Institute

In November 2020, he gave a $25 million grant to Singapore’s Wealth Management Institute (WMI), a not-for-profit educational and research institute, to train policy makers and investment professionals on universal principles of market behaviour. The grant was given from from Dalio Philanthropies to launch the Dalio Sustainable Market Principles Program.

Ray Dalio Profile (Bridgewater Associates)

Founder, Co-Chief Investment Officer, and Member of the Bridgewater Board

A global macro investor for more than 50 years, Ray Dalio founded Bridgewater Associates out of his two-bedroom apartment in NYC and ran it for most of its 47 years, building it into the largest hedge fund in the world and the fifth most important private company in the US according to Fortune Magazine.

His investment innovations (e.g., risk parity, alpha overlay, and All Weather) changed the way global institutions approach investing, and he has received several lifetime achievement awards. Over the decades he has been a valued macroeconomic advisor to many policy makers around the world. Because of the impact his thinking has had on global macroeconomic policies, he was named by TIME magazine as one of the “100 Most Influential People in the World.” Today, Ray remains an investor and mentor at Bridgewater and serves on its board. He is also the #1 New York Times bestselling author of Principles: Life and Work, Principles for Dealing with the Changing World Order, and Principles for Navigating Big Debt Crises.

Ray graduated with a BS in Finance from C.W. Post College in 1971 and earned an MBA degree from Harvard Business School in 1973. He has been married to his wife, Barbara, for more than 40 years and has three grown sons and five grandchildren. He is an active philanthropist with special interests in ocean exploration and helping to rectify the absence of equal opportunity in education, healthcare, and finance.

2021 Data Release 2020 List of Private Banks in Hong Kong2020 List of Private Banks in Singapore 2020 Top 10 Largest Family Office2020 Top 10 Largest Multi-Family Offices2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM Register Below Latest 2022 data & reports, insights & news Every Saturday & Sunday 2 pm Direct to your inbox Save 2 to 8 hours per week. Organised for success For Investors | Professionals | Executives New to Caproasia? Join 10,000 + Learn More | Sign Up Today Caproasia.com | Caproasia Access 2022 Events | TFC - Find Services Grow Business | Contact Us For CEOs, Heads, Senior Management, Market Heads, Desk Heads, Financial Professionals, Investment Managers, Asset Managers, Fund Managers, Hedge Funds, Boutique Funds, Analysts, Advisors, Wealth Managers, Private Bankers, Family Offices, Investment Bankers, Private Equity, Institutional Investors, Professional Investors Get Ahead in 60 Seconds. Join 10,000 + Save 2 to 8 hours weekly. Organised for Success. Subscribe / Sign Up / Contact Us Sign Up / Subscribe:

Mailing ListFree TrialPromo $20 MonthlyPromo $180 YearlyInvestor $680 YearlyProfessional $680 YearlyExecutive $2,000 Yearly

Interests / Events / Summits / Roundtables / Networking:

Private WealthFamily OfficePrivate BankingWealth ManagementInvestmentsAlternativesPrivate MarketsCapital MarketsESG & SICEO & EntrepreneursTax, Legal & RisksHNW & UHNWs Insights

Your Name*

Company*

Job Title*

Email 1 (Work / Personal)*

Email 2 (Work / Personal)

Contact No.

Country

Your Message (leave blank if none)

Owl Media Group takes pride in providing social-first platforms which equally benefit and facilitate engagement between businesses and consumers and creating much-needed balance to make conducting business, easier, safer, faster and better. The vision behind every platform in the Owl Media suite is to make lives better and foster a healthy environment in which parties can conduct business efficiently. Facilitating free and fair business relationships is crucial for any thriving economy and Owl Media bridges the gap and open doors for transparent and successful transacting. No advertising funds influence the functionality of our media platforms because we value authenticity and never compromise on quality no matter how lucrative the offers from advertisers may seem.